Why Relying on the Stochastic Indicator Alone Could Cost You

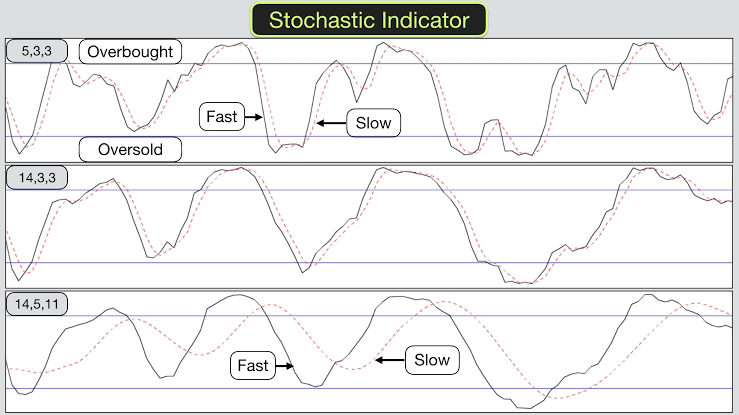

In the world of trading, indicators serve as invaluable tools, helping traders make sense of the complexities in the market. Among the vast array of technical indicators, the stochastic oscillator stands out for its popularity. It’s often celebrated for its ability to show potential overbought or oversold conditions, guiding traders on entry and exit points. However, as helpful as the stochastic indicator may seem, relying on it alone can be a dangerous trap. In fact, it could cost you more than you'd imagine. Here’s why.

Misleading Signals: The False Friend

The stochastic oscillator operates on the principle that prices tend to close near the extremes of the trading range during periods of upward or downward momentum. While this is true in many cases, it doesn’t always hold up under real market conditions. Markets are unpredictable and, at times, chaotic. Relying solely on the stochastic indicator can lead to false signals, making traders believe that an asset is overbought or oversold when it’s simply going through a temporary fluctuation.

For example, in strong trends, the stochastic indicator may show overbought conditions for an extended period. A trader who only looks at this signal might exit too early, missing out on potentially significant gains. Similarly, during a sharp decline, it might suggest an oversold condition prematurely, tricking traders into buying when prices are set to fall further. This can lead to substantial losses if not carefully managed.

The Danger of Ignoring Market Context

One of the critical mistakes traders make is using the stochastic indicator in isolation without considering the broader market context. The indicator doesn’t provide insight into market sentiment, fundamental factors, or macroeconomic conditions, all of which are crucial to understand price movements. Economic reports, geopolitical events, and even changes in interest rates can trigger market shifts that a stochastic indicator simply cannot foresee.

If you rely solely on this tool, you’re essentially blind to the bigger picture. For example, imagine a scenario where a stock shows oversold conditions on the stochastic chart, and you decide to buy based on this alone. However, if you had looked at broader market news, you might have seen that the company was facing a massive lawsuit or was about to release a poor earnings report. In such a case, relying solely on the stochastic indicator could cost you dearly.

The Need for Confirmation: Why One Indicator is Not Enough

Traders often make the mistake of trusting the stochastic indicator without waiting for confirmation from other indicators or tools. In technical analysis, the key to success often lies in a combination of tools that complement each other. The stochastic oscillator, for all its usefulness, should always be paired with other technical indicators like moving averages, RSI, or even fundamental analysis for a fuller picture.

Without confirmation, stochastic signals can mislead traders into premature or wrong decisions. Let’s say you see a stock showing an overbought signal on the stochastic oscillator. Before acting, checking for divergence with another indicator like RSI or waiting for a candlestick pattern confirmation could save you from entering a trade based on a false signal. Ignoring this step and jumping in based on the stochastic indicator alone could result in losses.

Emotional Bias and Overconfidence

Trading is often an emotional rollercoaster. When relying too heavily on a single indicator, like the stochastic oscillator, traders may develop a sense of overconfidence. The indicator may provide a string of correct signals, leading the trader to believe it’s foolproof. However, markets change, and what worked yesterday might not work tomorrow. Overconfidence leads to emotional trading, and emotional trading is a recipe for disaster.

By relying too much on the stochastic oscillator, traders might also become biased, filtering out information that contradicts their preconceived notions. This kind of tunnel vision can result in missed opportunities or, worse, unnecessary losses.

Overlooking Risk Management

One of the most dangerous aspects of relying on the stochastic indicator alone is the potential for ignoring proper risk management. Indicators, no matter how reliable, are not a replacement for a well-thought-out risk management plan. Even if the stochastic indicator provides what seems to be a perfect setup, no trade is guaranteed.

Successful traders know that risk management is just as important as the entry and exit points. This includes setting stop losses, managing position sizes, and never risking more than you’re willing to lose. By placing too much faith in the stochastic indicator, you might overlook these crucial risk management steps, setting yourself up for failure.

Conclusion: A Tool, Not a Strategy

The stochastic indicator, while powerful, is not a comprehensive trading strategy. It’s a tool, one of many, that should be used in conjunction with others. Traders who rely on it alone, without considering market context, ignoring risk management, or seeking confirmation from other sources, are at risk of costly mistakes.

To succeed in trading, you need a well-rounded approach. Use the stochastic oscillator as part of a broader strategy, combining technical analysis, fundamental research, and sound risk management. After all, no single tool can predict market movements with certainty. In the unpredictable world of trading, relying on just one indicator is a risk you don’t need to take.

Post a Comment